RingCentral

Q3 22’ SUMMARY

RingCentral delivered revenue and earnings that exceeded management’s guidance and consensus estimates as the business continued capitalizing on the megatrends driving cloud communications adoption. While the revenue was slightly below the Pragmatic forecast, this was largely driven by FX headwinds in the international business along with sales cycle elongation as customers adjusted spending behavior towards conservatism. Importantly, the earnings came in above the Pragmatic forecast as management continued to demonstrate that the business model has immense operating leverage.

RingCentral drove growth in the core subscription business, particularly in the domestic market. Similar to prior periods, the other products segment continued to be a headwind for the company; however, this line of business is becoming largely irrelevant. In Q3, RingCentral continued expanding the customer base and increasing wallet share. This momentum was visible across account sized as evidenced by continued expansion of ARR.

Overall, RingCentral is strategically positioned in the corporate communications industry, which enables the business to capture meaningful value from the megatrends currently playing out. The cloud migration driven by hybrid work, consolidation of systems, and transition away from on-prem services are massive tailwinds for RingCentral. The industry’s massive TAM continues to expand as hundreds of millions of paid seats head towards the cloud.

“Despite a difficult macro environment, we delivered a quarter that has exceeded our guidance across every key metric. Customers, partners and industry experts continue to recognize RingCentral as the leading cloud communications platform for business voice, messaging, video, and contact center. We intend to leverage and build on these strengths as we are addressing mission critical needs in markets that we believe collectively exceed $100 billion.”

Key Takeaways from Q3 22’

Key Takeaway 1- Continued core business momentum

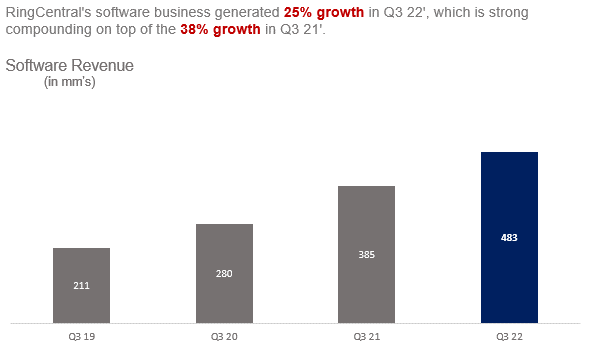

Subscription business continued to generate strong compounded growth.

Recurring revenue growth continued, which is making the underlying business much more durable.

RingCentral drove strong ARR growth in mid-market and enterprise segments.

RingCentral continued to close major several deals above $1mm/year.

Key Takeaway 2- geographic cross currents

RingCentral’s growth was driven by continued strength in the domestic business.

The international business generated modest growth after surging in the prior year period.

RingCentral continues to invest resources to scale the international business.

KEY TAKEAWAY 3- CLOUD COMMUNICATIONS SPENDING REMAINS ROBUST

While enterprises are slowing deal closings, intent remains high as needs for cloud-based services remain high.

Hybrid work continues to drive need for modern solutions.

Cloud players are taking share from on-prem legacy players.

GROWTH TRENDS

growth Factor 1- core subscription business

RingCentral’s core subscription business drove the company’s growth in Q3 as this line of business is the main beneficiary of the megatrends driving cloud based communication adoption. While the business has many subscription offerings, the core offering is the cloud based phone service. This allows users to access telephony services from any internet connected device as opposed to service that is only available via on-prem access. In other words, these users must use landline phones in order to use their corporate phone line. The only way around this is to offer employees a cell phone in addition to the landline, which is costly at scale. This is a massive opportunity as there are an estimated 400mm telephony seats across the globe, which is dominated by on-prem services. RingCentral leverages the business’ first mover advantage in the VoIP market to penetrate accounts, which positions the business to cross sell other services across the communications landscape. This is great positioning for the growing UCaaS and CCaaS market as RingCentral holds the largest share of cloud based telephony services.

RingCentral’s business model is uniquely designed to integrate the business into the architecture of the communications ecosystem. The business offers services directly to users in addition to offering service as a feature within another service such as Microsoft Teams. Additionally, RingCentral has managed to secure deals with legacy on-prem service providers such as Avaya (holds over 100mm seats) as well as cellular service providers such as AT&T. RingCentral’s competitive advantage extends into the developer community as users prefer to leverage software that is integrated into their most used applications. The business also has relationships with over 15,000 resellers, which is highly strategic as the corporate communications market is highly fragmented so deals with resellers ensures RingCentral is available wherever users shop for corporate communication services.

Secured several deals worth over $1mm in Q3.

The reseller channel accounted for ~60% of deals with an annual value greater than $1mm.

Launching an SMB and enterprise offering with Charter Communications.

Revenue split between new (60%) and existing (40%) customers, which is consistent with historic dynamics.

growth Factor 2- domestic and international markets

RingCentral’s opportunity spans the globe as the corporate communications industry is global. This makes sense given that communication as an activity is necessary for every company regardless of geographic boundaries. In fact, many companies must communicate with people across the world in a seamless manner. RingCentral’s domestic business is much more developed than the international business for many reasons. Importantly, the fact that the service is provider over the internet makes the business highly scalable. Management has been laying the foundation to replicate the business’ powerful model across the globe. This is a great move as the global industry is structured similar to the domestic industry, which gives RingCentral a clear path to scale.

growth Factor 3- secondary line of business

In Q3, the products sold under the “other” line of business contracted compared to the same period due to fewer customers purchasing physical phones from RingCentral. This is actually the result of bigger picture drivers that favor telephony services via RingCentral’s app rather than through a physical phone. Historically, RingCentral’s business model was based on selling a physical phone that is serviced by RingCentral. This hardware was essential to driving business as it provided users with access to RingCentral’s network. Advancements in internet speeds and smartphone data bandwidth has made access to the RingCentral tech through an app a viable path. This has many strategic benefits as users can use cellular phones they already own, which is highly likely to be a better device than the RingCentral hardware. So, this line of business is becoming less important for strategic reasons that favor the business scaling much faster than it otherwise would.

OPERATIONAL EFFICIENCIES

RingCentral continued to drive material operating leverage in Q3, which resulted in the business achieving record profitability. This operating leverage was driven by increased productivity as well as expense management. RingCentral continued to allocate material resources to driving growth through the global sales channel; however, this expense was well controlled in Q3. The business is demonstrating meaningful expense management capabilities, which are necessary to grow at scale. While there are still investments to be to drive further growth, RingCentral has achieved a level of scale that does not necessitate outsized OpEx. This is the key driver of operating leverage as RingCentral’s gross margins are already optimized given the high margin subscription business.

INDUSTRY TRENDS

While many were expecting corporate budgets to contract in 22’, spending on cloud based communications products and services expanded this year. This is the results of the cloud migration megatrend sustaining momentum as companies are still incentivized to transition communications hosting to the cloud. This has substantial economic benefits as well as operational benefits. As a result, companies are more inclined to migrate as the total cost of ownership will drive much needed ROI.

Another megatrend driving enterprise investments in cloud communications is hybrid work, which many companies are still not designed to optimally facilitate. The view that hybrid work was a pandemic dynamic has really lost support this year as majority of companies have retained a hybrid work schedule. This means that many decisions that were held off in order to observe workforce dynamics have to be acted upon. As a result, demand for video, chat, and phone cloud-based communication services are still in demand.

Lastly, the megatrend of vendor consolidation (UCaaS) showed no signs of slowing. Not only does a single vendor for video, contact center, chat, and voice reduce complexity, it also reduces costs for many companies. This translates to many cloud-based players offering UCaaS services that are taking even more share from traditional vendors who have had a tight grip on the industry for decades. The three megatrends have caused market research firms to continue forecasting strong double digit growth in 22’ and 23’, at least.

FORECAST AND VALUATION

RingCentral is well positioned to continue generating strong compounded growth in Q4 driven by the mass adoption of cloud based communication services. This strength is occurring across the business- SMB’s, mid-market, and enterprise organizations. RingCentral’s core voice offering is in high demand due to the time and cost savings that organizations realize upon migrating to the business’ cloud based service. This is further supported by RingCentral’s strategic integration with many players within the corporate communication ecosystem. The business’ consistent performance substantiates the durability of demand despite significant fears in the market about the economy trajectory across the globe.

RingCentral’s strong recurring revenues provides additional visibility into the business’ outlook over the next several quarters. The company continues to maintain price and customers, which is indicative of strong underlying demand. While many businesses have adjusted their migration plans, this is more of a change in the path of demand rather than the amount of demand. RingCentral’s leadership pointed to steady win rates as additional support for an optimistic outlook. Overall, the business is supported by megatrends that are not going to ease any time soon. There are hundreds of millions of phones still operating using legacy system that are inferior to cloud based systems. RingCentral’s continued integration within the market only strengthens the bull case for the business.

While revenue growth is expected to be strong, the real story is the massive increase in profitability driven by operating leverage and efficiencies. The business is well positioned to finish 22’ with material operating income and EPS growth, which is a direct result of management’s efficient approach to running the business. This has been many years in the making, which means the underlying cost structure is designed to continue adding leverage. RingCentral’s revenue and earnings growth makes the stock even more attractive as this growth materially compresses multiples. As the market sentiment turns positive, RingCentral’s stock is well positioned to materially increase as the earnings outlook is stronger than ever and the valuation is high attractive compared to the stock’s historic valuation levels.