RH

Q3 22’ SUMMARY

RH delivered revenue and earnings results that exceeded management’s guidance and consensus estimates; however, the results underperformed the Pragmatic forecast. While management communicated that conditions deteriorated in the Q2 call, the Pragmatic forecast did not project the degree to which this occurred.

The trends in the quarter were driven by several factors ranging from wealthy consumers holding back on spending, peers engaging in deep discounting, and RH Contemporary’s launch being tempered by lack of product availability. These conditions created a rare circumstance for RH as the business consistently gains share quarter after quarter. While this was not the case in Q3, the underlying business model and flywheel are strong as ever.

RH has a highly unique brand, store experience, and product assortment, which create sustainable competitive advantages. The business operates stores at much higher levels of productivity than peers as RH brings the scale of a large retailer and the product suite of premier boutiques. This luxury at scale is still a highly under-monetized asset, which is why the business is expanding the footprint domestically and internationally.

The furniture industry had record year in 21’ as demand for home goods surged. This led to severe backlogs that were largely worked out in 2H 22. Despite the headwinds in the latter part of 22’, the industry has a massive TAM that is distributed amongst a highly fragmented universe of players. RH’s position is firmly intact even though the core customer has experienced their own problems in 22’ as the stock market severely sold off.

“As previously mentioned, widespread discounting continues across our industry, and while it’s been almost two years since we’ve deployed a promotional email, we’ve been receiving two sale emails per day from many home furnishings retailers. Although the stark contrast in strategy may lead to a short-term risk of market share loss, we believe there is certain long-term risk of brand erosion and model destruction for those who choose the promotional path.”

Key Takeaways from Q3 22’

Key Takeaway 1- expanding store footprint

Design galleries are the future of the business as these showrooms are unrivaled in the furniture industry.

Outlet locations serve as a critical piece of the business’ inventory management strategy.

Legacy galleries still represent a significant portion of the strategy.

Key Takeaway 2- monetization cross currents

Demand per gallery fell as spending pulled back across the fleet.

Outlet demand also fell; however, it fell to a lesser degree than galleries.

Waterworks demand was actually strong despite widespread industry headwinds.

KEY TAKEAWAY 3- NEAR TERM FURNITURE SPENDING HEADWINDS

Spend trends started weakening in Q3 22’ followed by a meaningful pullback in November; however, there is no indication that overall demand has weakened as prices have fallen meaningfully compared to last year.

Market research firms continue to forecast material compounded growth over the next several years.

GROWTH TRENDS

growth Factor 1- footprint expansion

RH’s significant opportunity is still present despite headwinds being experienced due to external factors. The business’ footprint of unique and luxurious stores/showrooms is a significant competitive advantage as there is really no comparable furniture brand that has RH’s scale and premium product assortment. While the total Gallery footprint only increased 2% y-o-y, the underlying balance between legacy and design galleries tells a more accurate story. Much of RH’s growth in the last several years has come from the business making a major investment in the design gallery footprint while reducing the legacy gallery footprint. The design galleries are massive structures that are designed like boutique shops at a scale never seen.

While the headwinds in 2H 22 led to revenue contraction, the business has immense opportunity to continue taking share as the design gallery footprint is expanded. This is a critical growth driver as the business only has 28 design galleries through Q3 22’, which a represents material expansion opportunity. The design galleries are proven drivers of traffic at levels much greater than legacy galleries. Additionally, design galleries benefit from the strong popularity of RH’s restaurants inside of many design galleries. Importantly, management is committed to continuing investments in launching design galleries across the country as well as the launch of RH International.

growth Factor 2- footprint monetization

RH has a long track record of driving monetization of the business’ rather small footprint of locations. This trend experienced a rare fragmentation in Q3 22’ driven by the previously cited external factors. Additionally, the business likely experienced lost momentum due to lack of newness, which was supposed to be a growth driver in 22’. This is compounded by the management’s decision to not engage in the promotional activity that was rampant in the furniture industry after many experienced massive increases in ASP’s in 21’. These dynamics caused broad based weakness across product types and store formats, which is an indication that the headwinds were not caused by a strategic mistake made by management.

The underlying business position remains strong and will increase strength in 23’ as newness occurs across the business. The business has proven that galleries and outlets are highly productive, which is driven by the unique design of stores as well as unique products. Despite the headwinds RH’s business model remains strong, which means that monetization is highly likely to return to strong durable growth as the fundamentals are unchanged.

growth Factor 3- Waterworks business

While RH faced material headwinds in Q3, the Waterworks business demonstrated very strong outperformance. This business benefited from clearing of backlog as well as current period demand. The Waterworks product assortment is tailored to the kitchen and bathroom, which have different drivers than the furniture market. This diversification has proven highly valuable given the conditions in the core business. RH has significant potential to continue driving growth in this line of business as the footprint expands. Additionally, the business will benefit from the increased marketing that will occur across the business in 23’. Overall, this business has gained material significance for RH in terms of revenues derived from the Waterworks business.

OPERATIONAL EFFICIENCIES

RH’s significant scale has created material operating leverage in the business as a large portion of the cost structure is fixed or does not scale inline with revenue. While this has led to material growth in profits over the years, the pullback in revenue caused some of the recent operating leverage to reverse. Additionally, management continued to invest in the business’ strategic initiatives to keep the overall growth trajectory intact despite headwinds in 2H 22. Interestingly, management was able to raise product margins at a time when peers are deeply discounting products. While this likely led to share declines in the short term, it is an indication that management is focused on maintaining the brand and many consumers were willing to pay the premium. Overall, RH’s margins are still much higher than pre-COVID levels as the business has durable operating leverage. As a result, the compounded growth of earnings is far greater than the revenue CAGR.

INDUSTRY TRENDS

In Q3 22’, data from the BEA showed that home furniture sales increased at a similar rate as Q2 22’; however, growth in September turned negative. This growth was flat in October before decreasing -3% in November, which is material for an entire industry to contract at that level. Interestingly, there was considerable deflation in the goods sector in November as many retailers lowered prices to compete better and pass on reduction in input costs. This likely drove a material portion of the decline in November.

In 22’, market research firm Euromonitor continues to expect spend on living room furniture to decrease -2% followed by a flat CAGR through 26’. While there is wide variability in forecasts for home sales in units and dollars, the stabilization of interest rate hikes has positive effects on housing demand. Importantly, majority of spending on furniture is from remodels and replacement cycles rather than consumers purchasing new homes. Overall, the industry spend is still expected to remain stable, at least, which is very positive given the boom in the last two years.

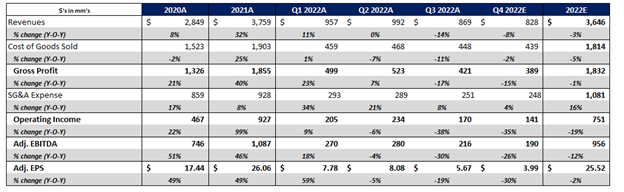

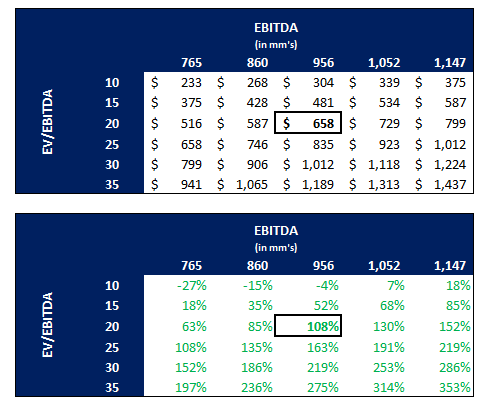

FORECAST AND VALUATION

RH is facing material headwinds as a result of pressure in the housing market as well as the affect that stock market declines have had on the wealth of high net worth consumers. Unlike other furniture retailers, RH decided to not discount products in order to move inventory as the business would risk brand erosion. These dynamics appear to have caused a broad based pullback from record spending in 21’. Additionally, RH’s difficulty fully launching RH Contemporary has likely contributed to the current trends as this product suite was supposed to be a material injection of newness. These headwinds caused operating deleverage as fixed cost coverage was reduced by the revenue pullback. Profitability was also impacted by management’s decision to continue investing in strategic initiatives including RH Contemporary, RH International, RH Guesthouse, and RH In Your Home. As a result, the Pragmatic forecast for Q4 22’ has been adjusted to reflect these unfavorable developments.

Overall, the business is still in a great position to resume taking share as conditions normalize. This will be occurring at the same time as RH’s full product portfolio revamp in 23’, which will be the most significant product refresh in the business’ history. While management did not comment on the potential affects of the lack of newness in the last few years, it could have offset the headwinds the business has been facing. Additionally, RH has significant runway from continued footprint expansion as the current footprint is far from maturity. The business has significant domestic and global expansion opportunities, which is really long hanging fruit as RH has a proven track record of taking share in every market the business enters.

The stock is still deeply discounted even with the reduced earnings outlook in 22’. The stock has been materially depressed in 22’, which has been far more severe than the business headwinds warrant. This is especially true when considering that margins are well above pre-COVID levels yet valuation is well below pre-COVID levels. The stock is still a prime candidate for a valuation reset as market sentiment shifts in 23’ as inflation normalizes, which will drive the Fed to adjust its policy. This is likely to have a compounded effect on the stock given the business’ exposure to the housing market.