Q3 22’ SUMMARY

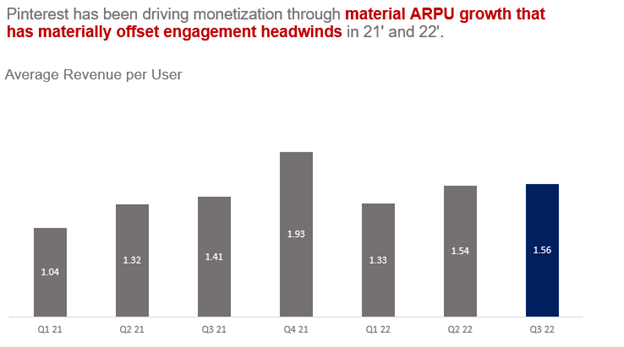

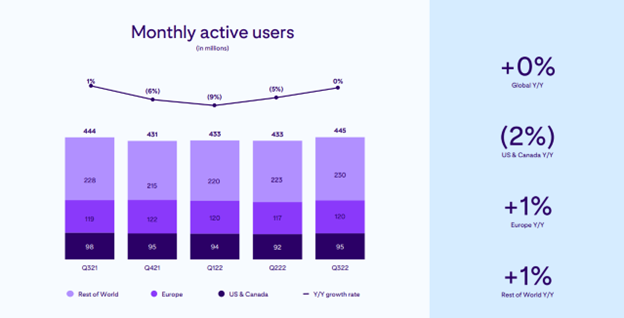

Pinterest delivered Q3 22’ results that beat both management’s guidance as well as Wall St. estimates. This outperformance was driven by a return to MAU (monthly average users) growth, which provides strong support that the engagement volatility due to COVID has now passed. Pinterest’s strong performance was also driven by continued ARPU (average revenue per user) growth as the business continues to drive monetization on the platform.

The business’ performance was especially strong considering the highly publicized headwinds across the entire digital advertising market. Meta and Snap both suffered massive stock declines due to materially weak results that were driven by ARPU compression.

Pinterest was able to gain share by executing on a compelling business model designed to grow a platform of commercially engaged users and leverage this “demand signal” data to drive monetization. Pinterest continued to benefit from capturing internally generated first party signals as Meta and Snap continue to suffer from the Apple privacy change given that these businesses relied on Apple to generate first party signal data.

Pinterest’s new CEO is demonstrating his e-commerce expertise by recognizing that Pinterest’s platform of commercially engaged users is a highly valuable asset that can be monetized across the full marketing funnel. The business is in a great position to continue growing now that user growth has turned positive after several quarters of contraction.

Overall, the digital advertising market is demonstrating resilience despite recent weakness relative to last year, which was a year marked by immense growth. Consumer behavior continues to drive digital advertising spend as advertisers need to “follow the eyes”, which continue to favor the digital channel. Pinterest is well-positioned to take even more share given the significant value advertisers can extract from Pinterest’s unique platform of commercially engaged users.

“Despite the challenging macro environment, we are delivering performance and a distinct value proposition to advertisers, reaching users across the full funnel. Through clear focus on increasing engagement that delights our users, we are deepening our monetization per user, and building personalized and relevant experiences that go from inspiration and intent to action.”

Key Takeaways from Q3 22’

Key Takeaway 1- positive engagement trends

Pinterest’s engagement trends have turned a corner with MAU’s growing sequentially for the first time since Q1 21’, which serves as strong evidence that the COVID headwinds have abated.

Engagement on Pinterest’s app continued to materially outperform engagement on the web-based platform.

Pinterest drove engagement by using machine learning to enhance personalization and relevance, which helped compound positive engagement trends driven by a massive increase in video content.

Key Takeaway 2- continued monetization momentum

Pinterest drove compounded ARPU growth despite industry headwinds due to increased user engagement as well as strength from CPG and retail customer segments.

The business drove monetization by selling advertisers on the benefits of using the platform across the full funnel (awareness, consideration, and conversion).

Pinterest continued to develop and introduced features that advertisers demand such as advanced measurement tools and conversion API.

Key Takeaway 3- MASSIVE digital advertising TAM

Market research firm eMarketer continues to forecast strong digital advertising spending in 22’ and 23’ despite headwinds many advertisers are navigating.

The firm also stands by the forecast that global digital advertising spending will continue growing despite macro headwinds in Europe.

Pinterest’s massive video content expansion positions the business to capture share of video advertising spend, which is growing much faster than other ad types.

GROWTH TRENDS

growth Factor 1- platform engagement normalization

After several periods of material engagement headwinds, engagement on the platform turned positive on an annual and sequential basis. This is a strong shift from trends in 21’ and 1H 22’, which serves as evidence that users engaging with the platform for COVID-related activities (home projects, cooking, etc.) have already left the platform. The absence of these temporary users has created a reasonable base for Pinterest to drive growth. In addition to trends normalizing on the platform, Pinterest has continued to introduce features that enhance the user experience. These features were developed using machine learning to create models to increase personalization and relevancy on the platform. For example, models were developed to identify complementary/related items based on Pins previously saved such as recommending chairs or rugs when table Pins are saved.

In addition to user experience enhancements, Pinterest has made significant strides in increasing the video content on the platform. As a reminder, Pinterest was well behind the curve on video content, which was likely an addition reason for Pinterest’s engagement headwinds. While the Idea Pins strategy is promising, the new CEO seems to have recognized that the timeline for scaling Idea Pins is just too long considering the present platform needs. Pinterest decided to broaden the scope of video content by allowing all users to upload video content from across the internet as a way to materially increase the amount of relevant video content on the platform.

Pinterest has also driven engagement by continuing to make the platform more shoppable. Platform users have a high commercial intent when they use the platform compared to other social networks. People use Pinterest to develop visuals for preexisting ideas related to a broad set of activities. Management has found that the platform had an “engagement leak” in which the dearth of shoppable content led users to leave Pinterest to initiate transactions. Overall, Pinterest has significant engagement opportunities within reach in 22’ and 23’, which positions the business well from a flywheel perspective.

Global app MAU’s increased much faster than global MAU’s as engagement on the app continued to outperform engagement on the website, which is the platform that many COVID-era people used.

Global app MAU’s increased 11% y-o-y (vs Global MAU growth of ~0%), which is highly relevant as app users account for 80% of Pinterest’s revenues and ad impressions.

Engagement by existing users increased faster than new user sign-ups, which indicates that those on the platform are responding very well to the additional platform features and content.

The video upload capabilities have led to video content increasing 3x y-o-y and uploaded content accounts for 50% of saved Pins, which is a significant indicator of engagement as only interesting Pins are saved.

growth Factor 2- significant monetization potential

Pinterest is on a journey to drastically increase the platform’s monetization as it remains in an under-monetized state. This means that the platform is essentially wasting money so long as the deficiencies exist. In effect, Pinterest’s platform and the platform’s monetization are misaligned given that the platform’s scale should be driving much greater ARPU than it has achieved. While Pinterest has been driving durable ARPU growth by developing and implementing a series of AdTech enabled features, the platform’s monetization is well below that of Meta and Snap. This disconnect is particularly interesting due to the fact that the platform’s are selling almost identical products in the form of impressions to consumers. Even more interesting is the rare commercial intent that Pinterest users possess which should make Pinterest ads even more valuable than other platforms that are more entertainment/socializing in nature.

Pinterest has continued to develop AdTech that is designed to advance the monetization journey. The focus of Pinterest’s AdTech is to make the advertising service more performance oriented thus helping advertisers more clearly see the value that ads on Pinterest create. These enhancements are in the form of insight-based selling, automation capabilities, campaign tools, measurement functionality, and ad format optionality. Advancements in these areas have been drivers of ARPU growth as advertisers have grown accustomed to these features from Meta and Snap. While impressions is the fundamental service that advertisers demand, advertising at scale is much more nuanced so additional functionality has become table stakes. In addition to delivering additional capabilities, Pinterest has continued to make strides in advancing the “shopability” of the platform. This is an important driver of monetization as it creates the link between commercial intent of users and conversions that advertisers pay top dollar to drive.

Pinterest was largely insulated from the intense headwinds within the small/medium size business (SMB) customer segment and the crypto, digital assets, and hard goods advertising categories. This insulation came from Pinterest having a customer base that over-indexes in large companies as opposed to a massive base of SMB’s like Meta and Snap. Additionally, Pinterest’s core customers are in the retail and CPG industries, which continued to advertise in Q3 unlike many other industries. Lastly, Pinterest’s first party signals continued to insulate the business from the measurement headwinds created by Apple’s privacy change in 21’. Meta and Snap continue to suffer from this loss of signal, which appears to have placed materially ARPU pressure on these businesses.

Pinterest drove demand across each sales funnel section, which led to 1/3 of revenue being derived from each section.

Spending intentions established in JPB’s increased 35% y-o-y, which is a material increase from the 25% in Q2 22’.

Conversion API launched to assist advertisers with measuring conversions outside of Pinterest derived from ads served on Pinterest.

Conversion API led to a 20% lift in conversions traced to advertising on Pinterest.

Conversion API and Tagging drove a conversion lift that was 36% greater than conversions from tagging alone.

Launched Pinterest Trends using the platform’s first party signals to help advertisers create ads based on interests demonstrated on Pinterest.

Shopping Ads increased 50% y-o-y driven by the introduction of catalog integrations and Shopping API.

growth Factor 3- scaling global platform

Pinterest’s opportunity is massive when considering the TAM of the global digital advertising industry. While the domestic business represents the large majority of Pinterest’s revenue, the international business is much larger from an engagement perspective. This presents significant monetization opportunity as Pinterest develops relationships with global advertisers. The company is focused on developing AdTech to monetize the domestic business more fully; however, the international business will be better monetized as the domestic business is placed in the right position.

In Q3 22’, Pinterest generated a positive shift in engagement across each global market. The monetization in the U.S. and RoW continued to generate growth consistent with the current trend. The business realized material ARPU headwinds in Europe due to the domino effect of the geopolitical tensions on advertising. This caused ARPU growth to slightly contract, which is a material divergence from the long standing trend of ARPU expansion. Importantly, Pinterest’s global platform has turned a corner on engagement and continues to address the monetization opportunity present in each market served.

OPERATIONAL EFFICIENCIES

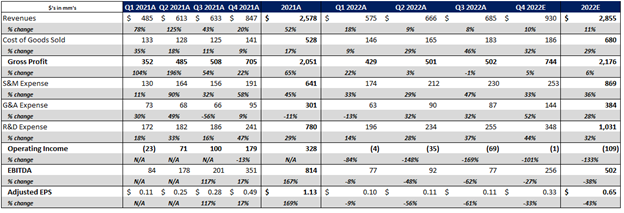

Pinterest has continued to retain a large degree of the operating leverage generated in 20’ and 21’. This leverage has been driven by Pinterest’s MAU levels as well as the massive monetization growth driven since 20’. The business delivered EBITDA and EPS performance that exceeded guidance and Wall St. estimates due to stronger topline growth as well as expense timing.

While margins materially compressed in Q3 22’, this is more of an investment in future growth than operating deleverage from inefficiencies. Pinterest has made 22’ an investment year with margin allocated across the cost structure to prepare Pinterest for the next level of development. Majority of the additional expenses relate to model development and sales related activities. These investments position the business for accelerating growth in 23’ as well as operating leverage as 22’ becomes the base for growth calculations.

INDUSTRY TAILWINDS

While the digital advertising industry has been receiving significant negative press in recent times, the underlying market remains intact. This is largely driven by megatrends that transcend negative sentiment and uncertainty. The fact is that business have integrated advertising into their business models, which means that they need to continue advertising in order to drive traffic and sales. If businesses could simply grow without advertising then they would have done so many years ago. Interestingly, competition for consumer’s dollar incentivizes businesses to continue advertising to attain mindshare above the competition.

Advertisers are certainly becoming more selective with their spending as they are focused on identifying advertising with a measurable ROI. This means that some players will win share at the expense of others that lack demonstrable ROI advantages. Companies are continuing their hiring, consumers are continue their spending, and digital activity continues compounding. These are likely to drivers behind market research firm, eMarketer’s forecast for continued strong growth over the next several years on a domestic and global basis.

FORECAST AND VALUATION

Pinterest is well-positioned to continue generating meaningful growth in Q4 22’. Management’s guidance is conservative given the seasonally strong Q4 which is driven by high demand from retailers. This year should be particularly strong given the need that retailers have to sell thru the significant inventory many retailers are holding. Pinterest should also be a beneficiary of the advertising headwinds at Twitter even if they prove to be temporary. The business’ recently launched AdTech innovations should also support the business given that the prior year period did not have many of these innovations. Pinterest is also in a great position given the return to MAU growth and higher engagement of active users. This creates additional monetization opportunities for the business in Q4 and beyond.

The business is likely to continue realizing compressed margins in Q4 22’ as the company completes the investment year. This sets the business up well for meaningful growth and operating leverage in 23’ and beyond. As a result, Pinterest’s stock is highly unlikely to continue trading at suppressed valuations. The key catalyst for the stock is macro and micro related. On the macro front, lower CPI readings are going to drive market sentiment in a material way. On a micro front, continued execution on strategic initiatives is going to lead to growth that exceeds expectations. Overall, Pinterest’s stock is poised for a valuation reset once sentiment shifts. This valuation reset is likely to be applied to even higher profit levels thus supporting material price appreciation from current levels.