G-III Apparel

Q3 22’ SUMMARY

G-III delivered revenue that outperformed management’s guidance and consensus estimates in Q3; however, the business materially missed on the earnings front. These mixed results were driven by continued demand for G-III’s premium assortment of apparel goods under several brands combined with a sharp increase in costs related to an execution misstep relating to inventory planning.

More importantly, the stock fell sharply on the news that PVH had decided to not renew the licensing relationship with G-III, which would largely come into effect in 2027. The relationship with PVH covers the Calvin Klein and Tommy Hilfiger brands, which generates 48% of G-III’s revenues. While G-III’s owned brands have increased significance over the last several years, the licensed brands are clearly material. In response, leadership shared that plans are being designed to replace the lost revenue when the businesses part ways. G-III is currently unable to initiated additional relationships that would replace these revenues due to deal restrictions. Otherwise G-III would likely already have deals in place to preemptively address the contracts expiring.

Importantly, the business is ran by a highly competent and motivated leadership team that has substantial stakes in the business. G-III has a demonstrated ability to design and deliver products that resonate with consumers, which can be applied to other world class brand names. Additionally, the business is in a great position to continue driving growth in 23’ as the apparel TAM remains massive, which represents significant opportunity for G-III to continue taking share.

“For the third quarter we met our top-line expectations delivering net sales of $1.08 billion up more than 6% compared to the prior year, as we continued to make progress on our strategic priorities. Our higher inventory levels are due to our accelerated production calendar, which was in anticipation of longer supply chain lead times.

Calvin Klein and Tommy Hilfiger have been an important part of our business. Today we announced staggered extensions by category beginning January 2024 and continuing through December 2027. We do not expect significant reduction in net sales, net income and cash generation from these businesses for the next three years. We believe these extensions will allow us time to accelerate our long-term strategy.”

Key Takeaways from Q3 22’

Key Takeaway 1- Channel strength

Continued momentum in the wholesale channel driven by proprietary products.

Retail channel continues to scale after massive shrinking post-divestures.

Licensed products continued to lag proprietary in wholesale channel.

Key Takeaway 2- proprietary momentum

Revenue from proprietary products generated strong growth driven by demand for owned brands.

Sales from international markets added to strength in the quarter.

Key Takeaway 3- massive apparel tam

Spending remained strong as consumers continued adding to wardrobes.

Momentum persisted beyond Q3 as strength continued through the end of 22’.

Market research firms continue to project that the apparel industry’s 5yr CAGR through 26’ will outpace the 5yr CAGR through 21’.

GROWTH TRENDS

growth Factor 1- wholesale momentum

G-III has an important place inside of the fashion departments of many of the most well-known retailers including Macy’s, Dillard’s, Saks Fifth Avenue, Nordstrom, Kohl’s, TJX Companies, Ross Stores and Burlington. This positioning is driven by the need for these retailers to offer consumers access to G-III’s power brands- DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger and Karl Lagerfeld Paris. The business has developed deep relationships with these retailers over many years, which creates a deeper connection to this customer segment. G-III has gained the confidence of these retailers by designing and delivering fashion forward apparel that consumers adopt at scale. As a result, G-III has become a trusted partner that retailers rely upon to bring insights into what types of fashions consumers happen to be interested in at any given time.

In Q3, G-III saw meaningful demand from wholesale customers driven by continued momentum in consumer spending on apparel goods as the post-pandemic wardrobe refresh is still underway. While retailers demonstrated meaningful conservatism from an inventory management perspective, many were able to hold the line of prices despite widespread price reductions across the retail sector. Specifically, many department stores decided to engage in lean inventory strategies, which resulted in moderated orders from manufacturers. This impacted G-III’s revenues as the wholesale channel is by far the most significant for G-III. These retailers have a large pool of potential customers so G-III needs these retailers in order to capture the interest of consumers. Going forward, G-III is well positioned to deliver even greater levels of product as retailer conservatism normalizes once recession fears dissipate.

growth Factor 2- proprietary brand strength

G-III’s business model is based on bringing world-class design and merchandizing capabilities to well-known brands at scale. While brand names matter to a large contingency of consumers, it is the design that attracts consumers to make the purchase. In other words, fashion is based on a combination of brand recognition as well as appealing designs. G-III has been highly successful in acquiring rights to many well-known brands, designing great products under these brand names, and selling them to a large book of retailer customers. The business has also been successful at purchasing brands outright then applying the same playbook to these owned brands. While many consumers do not know "G-III”, they certainly know the brands that G-III is behind.

G-III owns many well-known brands including DKNY, Donna Karan, Vilebrequin, G.H. Bass, Eliza J, Jessica Howard, Andrew Marc, Marc New York, Wilsons Leather and Sonia Rykiel. The business also has long-term rights to other well-known brands including Calvin Klein, Tommy Hilfiger, Karl Lagerfeld Paris, Levi’s, Guess?, Kenneth Cole, Cole Haan, Vince Camuto and Dockers. Through G-III’s team sports business, the company has licenses with the National Football League, National Basketball Association, Major League Baseball, National Hockey League and over 150 U.S. colleges and universities. While the portfolios are massive, G-III generates the vast majority of revenues from what the business calls their five global power brands- DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger and Karl Lagerfeld Paris.

In recent periods, G-III has driven more growth from owned brands than licensed brands. This is driven by the business scaling acquired brands in a concerted manner as leadership believes these brands are under-monetized on a global basis. G-III also has more control over these brands, which enables the business to create products across categories whereas the licensed brands are under separate contracts based on category and geography. While the relationship with the parent company of Calvin Klein and Tommy Hilfiger (PVH) will be ending in 2027, G-III still has significant monetization potential with these brands. Additionally, the business has plenty of other brands that can be potential partners. Importantly, G-III still has the IP and relationships to take another brand to the same scale as they took the PVH-owned brands.

growth Factor 3- rebuilding retail business

G-III made the critical decision to exit underperforming business during the pandemic, which materially reduced sales in the owned retail channel. These decisions allowed leadership to focus on building acquired brands that had much more name recognition in the marketplace. This is G-III’s competitive advantage- leveraging a renowned brand to monetize the business’ world-class merchandising capabilities, developed supply chain, and massive wholesale distribution. Now that G-III has exited from the faltering brands during the pandemic, the business is focused on rebuilding the retail strategy with stores for the company owned brands. The stores for DKNY and Donna Karan are demonstrating material early success, which is evidenced by the retail growth rate as well as monetization per store that is much higher than stores of the divested brands. Additionally, G-III continues to develop e-commerce capabilities for the owned brands, which presents additional monetization opportunities.

OPERATIONAL EFFICIENCIES

After drastically improving the business’ cost structure during the pandemic by exiting underperforming brands, G-III experienced material margin compression in Q3. This reversal was driven by operating inefficiencies that were the result of management’s overestimation of shipping times. Management’s inventory strategy was based on an operating assumption that shipping times would be much greater than they ended up being. This is a clear indication that management did not anticipate the massive drop in goods being shipped over the Q3 period. As a result, G-III had to scramble to identify warehousing and logistics solutions so the business could take possession of the goods that arrived “too soon”.

Additionally, G-III experienced margin compression from an increase in input costs. This increase was offset by G-III’s price increases which were absorbed by department store customers. These dynamics drove profits below Q3 21’ levels, which was not anticipated. Importantly, the business is still operating with a highly efficient cost structure that will outlast the short term spike in expenses related to the inventory planning misstep. As a result, G-III is still in a great position from an efficiency perspective despite the missed expectations in Q3.

INDUSTRY TRENDS

Demand for clothing remained strong in Q3 as consumers continued spending on clothing. This strength continued in the most recently available data through December 22’, which indicates that spending at clothing and clothing accessories stores continued growing in Q4. This is particularly indicative of an enduring trend as consumers had already spent so much on apparel in 21’ and 1H 22’ as many people needed to refresh their wardrobes after the pandemic eased, which led to sharp increases in outdoor activities. While many firms are communicating that they are observing demand moderation, the aggregate data indicates that consumer demand for apparel remains strong. Also, there are many firms that had more inventory than demand support so price cuts were reported across many national and global firms that sell apparel products.

Going forward, market research firms are still forecasting growth through 26’ that exceed the pre-pandemic rate. This reflects a shift in consumer demand for apparel post-pandemic. While it is impossible to identify the drivers with certainty, the increased outdoor activities likely plays a part in increased demand for apparel as these products are complementary to traveling, dining out, and participating in events. It appears that the pandemic has fundamentally shifted demand for socializing, which has the domino effect of shifting demand for apparel products to go along with the socializing.

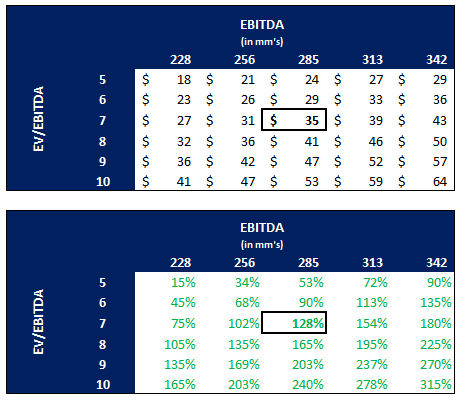

FORECAST AND VALUATION

G-III is positioned to finish 22’ with moderate growth in Q4, which reflects compounding on top of the immense growth of 42% in Q4 21’. The business’ core product strategy is firmly intact as evidence by G-III being able to continue taking price despite the deflationary pressures in the retail industry in 2H 22. While raising prices at a time that others are cutting has likely led to reduced volumes, the business’ share gains despite being priced above market is an indication of strong product demand. G-III’s position in mid-tier department stores contributed to the resilience as these retailers were able to hold pricing power given the above average spending power of the higher income customer that shops at mid-tier department stores.

Importantly, G-III’s compelling assortment of designer brands across product categories positions the business to continue growing, especially as price cuts begin normalizing. In the meantime, G-III is likely to generate moderated growth relative to Pragmatic forecasts driven by wholesale customers (department stores) continuing to exercise conservatism in terms of order sizes. While end consumption remains high, department stores do not want to risk having too much inventory on hand in the event consumption turns a negative corner. Overall, G-III is positioned to return to outperforming 19’ levels despite having a much smaller contribution from owned retail stores.

While G-III’s operational inefficiency in Q3 was a disappointment, these elevated expenses were largely one-time in nature. The business appears to have absorbed the worst of the expenses related to ordering too much product. As a result, the business is positioned to return towards normal gross margin levels, while OpEx is likely to remain moderately elevated in Q4 22’. These cross currents are likely to result in another quarter of margin compression compared to record margins in 21’. Importantly, the compression is not structural, which means that G-III is well positioned for margin expansion in 23’ as the business still has material efficiencies in the cost structure that were overshadowed in 22’ from temporary spikes in expenses.

G-III’s stock fell materially when earnings were announced as the business also shared that the licensing relationship with PVH would be ending by 2027. While this is certainly a material development, the market reacted as if G-III’s business fundamentally changed overnight. The business is operated by a supremely experienced leadership team that already has plans in place to replace the lost revenues when the time comes. Importantly, the deal is in place for the remaining three years so the business’ financials will not reflect the sunsetting of the PVH relationship for years. In fact, the financials may potentially never reflect the lost business so long as G-III successfully develops and executes a replacement strategy between now and then.

The massive drop in stock price drove valuation to multi-year lows despite the prospect of accelerated earnings growth in 23’. This has created an even deeper discount of the shares that is unlikely to remain in 23’ as the market revisits the business. In fact, this has already started to take place with the stock increasing 35% from the initial drop in December. In 23’, the stock is highly likely to increase beyond 22’ levels as the market turns positive on the macro front followed by G-III’s leadership making the market confident in the replacement plan. Overall, it is hard to imagine a scenario in which G-III delivers accelerated earnings growth in 23’ and a solid replacement plan yet investors refuse to pay anywhere near normal multiples. This is especially difficult to imagine given that the business’ cost structure is far more favorable than it was when the multiple was double the current multiple.