Etsy

Q3 22’ SUMMARY

Etsy delivered revenue and earnings results that exceeded management’s guidance and consensus estimates. The business’ results also exceed Pragmatic estimates on both the top and bottom line. This outperformance was driven by continued execution on the business’ winning strategy of linking makers (sellers) and enthusiasts (buyers) all over the world. Etsy continued to monetize the massive platform that offers over 94mm buyers unique, non-commoditized products from over 7mm sellers.

While Etsy has been managing engagement headwinds from immense growth in 20’ and 21’, the business successfully reached normalization in net customer acquisitions in the quarter. This is a major positive as many e-commerce players that experienced massive growth in 20’ and 21’ are now facing acute growth fatigue as consumers have increased physical shopping behaviors compared to 20’ and 21’. Players with industry leading platforms that have massive scale on both the seller and buyer sides of the network have managed to retain much of their recent scale.

Etsy continued to demonstrate that the platform serves a differentiated role in the entire retail landscape not just e-commerce. Etsy offers millions of buyers products that they just won’t find anywhere else while offering sellers are highly engaged marketplace with a scale they just won’t find anywhere else. In Q3 22’, Etsy continued to deliver platform enhancements that drove engagement initiatives, which have materially offset headwinds in the e-commerce market. The business’ recent platform fee increase and ad revenue service were material drivers of growth in Q3 22’. Overall, Etsy is well positioned in the high growth e-commerce industry. Additionally, Etsy stands alone in regards to players that have the scale to connect millions of buyers and sellers of niche, unique products that will not be found on Amazon.

“We are pleased that Etsy’s business has remained strong in a volatile environment and we believe our sustained performance is a testament to Etsy’s unique position in e-commerce where, in a world of mass commodities supplied by companies obsessed with speed and scale, Etsy is the antidote.”

Key Takeaways from Q3 22’

Key Takeaway 1- platform engagement normalization

Etsy has successfully stabilized active buyer trends by creating compelling advertising, communicating the massive breadth and depth of the platform, introducing personalization and advanced search features, and carrying a massive seller base.

Etsy has maintained the platform’s massive seller base by introducing creative ways to engage and educate sellers on best practices to drive their Etsy shops.

Key Takeaway 2- platform monetization momentum

While Etsy faced gross marketplace sales (GMS) headwinds, the business offset these headwinds with strong GMS performance in non-US market as well as the mobile platform.

Etsy drove monetization by increasing the transaction fee charged to sellers to reflect the unique value proposition Etsy is delivering to sellers as well as continued monetization of on-platform advertising services to sellers.

Key Takeaway 3- MASSIVE e-commerce TAM

Market research firm Euromonitor is projecting strong global growth in 22’ and beyond.

Euromonitor is projecting US e-commerce to also generate strong growth.

E-commerce players continue to introduce more compelling user experiences to drive traffic away from physical stores.

GROWTH TRENDS

growth Factor 1- strong platform engagement

Etsy’s massive platform is a significant source of value for the business as there is vast untapped value within platforms as large as Etsy’s. The platform is essentially a two-sided network with buyers on one side and sellers on another. These players have a reciprocal relationship in that sellers attract buyers while buyers attracts sellers. To buyers, sellers represent choice as these sellers are sources of unique products. To sellers, buyers represents earnings potential as these buyers are prospective customers. This is the essence of any platform and Etsy has done a phenomenal job building a global platform that serves as a meeting ground for sellers of unique, handmade products and buyers who are highly interested in purchasing these rare finds. In many cases, buyers and sellers are in different countries from each other, which means they would be very unlikely to ever cross paths. The platform’s massive scale of 94mm buyers and 7mm sellers has made Etsy a powerful broker for these buyers and sellers.

Similar to other e-commerce players, Etsy experienced a massive increase in engagement in 20’ and 21’ as consumers flocked to digital shopping in response to the pandemic’s affects on physical activity. In Etsy’s case, millions of buyers purchased custom masks to wear during mask mandates across the world. While the surge in demand was a welcome tailwind, the underlying driver was clearly temporary thus creating a future growth headwind. Similar to other e-commerce players, Etsy experienced a pullback in engagement early 22’. Unlike many other e-commerce players, Etsy’s pullback was shallow and brief. The sequential deceleration started about two quarters after many other e-commerce players, was much more shallow of a pullback, and ended after just two quarters.

Etsy’s strength during this time was driven by the business’ strong value proposition that compelled new buyers to return even after the pandemic. Etsy has done a great job driving engagement on both the buyer and seller sides of the platform by continuously introducing compelling features. For instance, Etsy introduced upgraded personalization and search models that have driven conversion rates. On the seller side, Etsy introduced global events for the first time that serve as knowledge sharing opportunities in which Etsy shares insights from the massive data created on the platform. Additionally, Etsy has launched a Star Seller program that rewards top tier sellers with premium placement and branding, which drives these sellers’ Etsy stores.

49% of buyers are repeat buyers vs 41% in Q3 19’.

7.6mm buyers are “habitual”.

Search enhancements launched in non-US markets.

Etsy seller app launched in non-US markets.

Search by image recently launched.

growth Factor 2- strong and stable platform spending

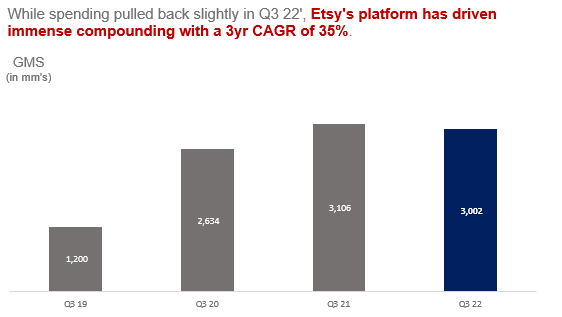

Etsy’s massive platform growth has driven immense growth in spending as increasing amounts of buyers are finding increasing options from the increase in sellers. This cycle of growth is the bedrock of Etsy’s business model as it creates momentum, which makes growth much easier to achieve. The platform boasts many millions of products for buyers to shop, which has been made simpler with the search and personalization advancements. While GMS growth experienced a slight pullback in Q3, this was driven by FX headwinds as Etsy has a massive international business. Additionally, growth was negatively affected by headwinds in the web-based platform, which has not been as strong as the mobile platform. The international platform has also materially outperformed the domestic platform as Etsy still has considerable business development taking place in the massive global retail market. Lastly, management has shared that prices on the platform have actually decreased over time, which means that Etsy is not being directly affected by inflationary pressures.

Etsy has cross sold many buyers who came to the platform for pandemic related products.

Fashion, bags, gifting, and holiday product categories drove spending in the quarter.

Home and craft supply product categories were stable in Q3 after several periods of regression.

Etsy has products in seven categories that each have at least 15mm buyers.

Etsy has products in 15 categories that each have at least 1mm buyers.

growth Factor 3- Platform monetization momentum

Etsy continued to demonstrate an impressive ability to build a powerful platform then monetizing that platform in a material way. In Q3 22’, Etsy offset the slight pullback in GMS by driving an increase in platform take rate (revenues as a percentage of GMS) driven by the business’ ability to capture increasing value from the massive spending on the platform. This increase in take rate was driven by Etsy’s recent transaction fee increase and stronger ad revenues. As a result, Etsy’s marketplace and services revenues increased over the strong growth in Q3 21’, which is a material outperformance against other e-commerce players.

Search improvements, personalization improvements, video capability introduction, and delivery transparency (non-US) drove conversion rates.

Sharing data analytic insights with sellers helped them to optimize tactics, which drove conversions.

Ad revenues increased 14% driven by home page ads and personalized ads.

Transaction fee increased from 5% of GMS to 6.5% of GMS.

Platform take rate increased from 17% in Q4 21’ to 20% in Q3 22’.

OPERATIONAL EFFICIENCIES

Etsy delivered stronger than expected profitability in Q3 22’ as the business was more efficient than projected. While the margins compressed from Q3 21’ levels, Etsy previously communicated that 22’ would be a year of transition for the business from a cost structure perspective. Etsy focused on capturing the massive demand in 20’ and 21’ so the business reallocated some R&D dollars to sales and marketing. This was a powerful move as it enabled Etsy to maximize flow to the platform, which gave the business an opportunity to win long-term business from many of these new buyers. Given Etsy’s platform-based business model, the surge in buyers led to a surge in sellers, which ultimately attracts more buyers. From an efficiency perspective, Etsy’s margins expanded massively during 20’ and 21’ as revenues surged ahead of expenses.

While this is great, a portion of the efficiency gains were temporary as Etsy would eventually increase expense allocation levels. Etsy has invested considerably in research and development by way of engineering headcount increases to support the business’ growth initiatives. This increase in talent is absolutely necessary for Etsy to actually deliver the personalization and search upgrades that will drive platform monetization. Overall, margins are still much higher than pre-pandemic levels as the business has reached a scale that more than covers the incremental expenses to grow the business over the next few years. Importantly, the inefficiency is highly likely to be limit to 22’ as the relationship between revenue and expense growth returns to an efficient dynamic.

INDUSTRY TAILWINDS

The global e-commerce market has remained strong despite facing massive base effects from the surge in demand during 20’ and 21’. While some projected that the balance between physical and digital shopping would remain at levels reached during the pandemic, there has been a partial regression since many pandemic lockdowns were lifted. Even still, the spending in e-commerce remains fundamentally stronger than pre-pandemic levels. This is especially beneficial for leading players who are taking share from businesses that have substandard platforms.

In 22’, market research firm, Euromonitor, is projecting global e-commerce spending to reach ~$4.1 trillion, which is a 16% increase from 21’ levels.

In 22’, Euromonitor, is projecting global e-commerce spending to reach ~$4.8 trillion, which is an 18% increase from 22’ levels.

In 22’, Euromonitor is projecting e-commerce spending in the US to reach ~$891bln, which is a 13% increase from 21’ levels.

In 23’, Euromonitor is projecting e-commerce spending in the US to reach ~$985bln, which is an 11% increase from 22’ levels.

Euromonitor is projecting e-commerce spending to continue growing at low double digit levels on a global and domestic basis.

FORECAST AND VALUATION

Etsy’s strong performance in Q3 sets the business up for a strong finish to 22’, which is very impressive given the massive base effects the business had this year. While management provided highly conservative guidance for Q4 22’, this is due to a material measure of caution regarding factors outside of management’s control or influence. In fact, management communicated that trends within Q4 indicated that the business would deliver results well above the midpoint of guidance. While this is a prudent communication strategy, it depicts performance that is unlikely to become reality. A more conservatively realistic forecast for Q4 is one that projects healthy moderation from Q3 performance, which takes into account headwinds while still recognizing that momentum continues to be strong despite the headwinds.

Etsy’s performance is likely to be driven by continued monetization of the platform through transaction fees on platform spending as well as service fees from providing value added services to sellers. While gross spending value is likely to remain challenged, this is mitigated by non-US gross spending remaining strong as well as mobile spending. Additionally, Etsy has demonstrated that the business is driving strong new buyer acquisition momentum as well as reengaging lapsed buyers. While the business is likely to generate more moderate services revenue in Q4, this is due to lower projected ad revenues as buyers don’t need as many ads to drive conversion given the high commercial intent during Q4. Lastly, Etsy’s higher transaction fee provides the business with a material offset to spending headwinds during this transition year. Importantly, the business is well position to generate accelerated growth in 23’ as churn continues to slow and monetization initiatives gain traction on a material level.

While Etsy is likely to realize continued margin compression in Q4, there are several positives on the efficiency front beneath the compression. Firstly, most of the compression is due to a return to R&D spending after materially reducing this spending category on a common size basis. This is a critical spending category that will drive future growth from the business being able to develop and implement platform enhancing features. Importantly, the business should realize margin expansion in 23’ as the uptick in spending normalizes and revenue growth accelerates. As a result, Etsy’s stock is reasonably worth much more than the current valuation implies. Like so many other stocks, Etsy’s stock is being materially suppressed by negative sentiment. Interestingly, the stock has had a strong run since the earnings report, which is a welcome signal that investors are starting to hold onto Etsy’s stock a little tighter. Importantly, the stock’s valuation is high likely to reach significantly higher levels as the business delivers outperformance and the market turns positive on growth stocks in 23’.